The MEV Bible Part 2 of 2

A Journey into the Heart of Blockchain’s Decentralization Challenges and its Solutions.

Introduction

Welcome to Part 2 of the MEV Bible (Part 1 here), where we’re about to embark on a deep dive into one of the blockchains most intricate complexities, known as Miner Extractable Value, or our buddy, MEV. Now, you might be asking, “Why should I care about MEV?” Strap in, because it’s more than just a simple technical glitch. It’s a fascinating issue that catapults us right into the epicenter of the blockchain universe’s grand dilemmas around authority, equality, and the true spirit of decentralization.

Think of MEV as a wild creature, hidden within the intricate labyrinth of the blockchain ecosystem. It’s an unintended consequence of blockchain’s transparency and transaction sequencing. And while some may argue it’s an inherent part of the system, others warn it has the power to stir up some serious chaos.

The MEV Battle Continues

We’ll be exploring the arguments of those who view MEV as a cornerstone of the blockchain, and contrasting these with the views of those who see it as a nuisance that needs to be eradicated. We’ll shed light on why MEV could potentially morph into a monumental problem for the blockchain universe, and also bring into focus some innovative strategies aimed at taming this beast. These strategies range from auctions and cryptography to ensuring fair transaction ordering and even good old-fashioned regulation.

So, as we navigate this journey, the central question we’ll grapple with is whether we allow MEV to roam free, potentially jeopardizing the core principles of decentralization, or whether we channel our creativity to devise ways that empower users and foster a more equitable and inclusive crypto environment. The stakes are sky high and the outcome has the potential to reverberate across the entire blockchain cosmos. So let’s dive right in, shall we?

What’s the MEV Supply Chain?

So now that you understand what MEV is from part 1 of this series, let’s introduce the different actors in this ecosystem and how they interact with each other.

The picture above shows at a high level the current actors involved in the MEV industry today.

User — Anyone that wants to make a transaction on the Ethereum blockchain.

Wallet — An interface that the user utilizes in order to connect to the blockchain and send transactions through. To take Stephane Gosselin’s (from the above image) definition, a wallet in this instance also includes everything at the application layer: dApp UI, wallet, and smart contract protocol.

Searcher — These are the actors who are actually running various MEV strategies to profit from the sequencing or reordering of transactions.

Builder — Transaction aggregators that actually construct the block. Prior to PoS, this was the job of the miner while in PoS this is actually done by the validators. With regard to L2, this work is delegated to the sequencers.

Validator — Actors who validate and finalize blocks. Currently validators and builders are the same entity, but there’s ongoing research into separating them into two distinct roles.

When we look at the current system, Flashbots is clearly the leader in the MEV space. At one point, they even had over 90% of Ethereum miners using their services. The system that Flashbots built is essentially a version of Proposer/Builder Separation, which we’ll touch upon later on — for now, the picture below does a good job of depicting how block building happens.

Utopia or Dystopia?

Taking inspiration from Stephane again, centralization within the MEV supply chain can cause a blockchain to trend towards what he calls “Utopia” or “Dystopia.”

MEV or “Miner Extractable Value” can lead to two potential futures — a utopia or a dystopia, based on how it’s managed and developed.

A MEV Utopia would involve an open and fair system where everyone has an equal chance of benefiting from the reordering or inclusion of transactions. This would be a system where MEV is democratized, and no one player has an unfair advantage over others. Technical solutions would be created to ensure that all actors have an equal opportunity to extract MEV, preventing a small group from dominating the blockchain.

On the other hand, a MEV Dystopia would emerge if the control and benefits of MEV extraction are concentrated in the hands of a few. If powerful actors can exploit uneven access to information and manipulate transaction ordering for their own gain, it could lead to a system reminiscent of traditional finance, where retail investors often end up at a disadvantage. This could result in issues such as flash crashes, cascading failures, and censorship, hurting regular investors.

In essence, the outcome depends on how the crypto community addresses the issue of MEV. It can either lead to a fair and equal system (a utopia) or a system that favors the powerful and leaves regular investors at a disadvantage (a dystopia).

Understanding MEV: Two Different Views

Before we get into the problems and solutions to MEV, let’s first introduce two of the main of the philosophical underpinnings of MEV.

MEV is fundamental and should be democratized — MEV is not only a fundamental property of blockchain networks and it’s not going away.

MEV is detrimental and should be removed — MEV has no societal benefit and taking advantage of it is actually detrimental to the network participants.

Why is MEV Fundamental?

Auditbility — Users can check the status of the blockchain, which makes the network more open. But this checkability also means we can know what the results of actions will be, which can lead to bribing. Since results are decided by the order of transactions and validators can set this order, auditability can also lead to MEV in blockchain systems.

Interoperability — Different blockchain networks and systems can work with each other. But since each of these systems is built differently and has different trust levels, these differences can probably be sources of MEV for those who control the order of blocks.

Diverse Fairness Models — There’s no one-size-fits-all idea of fairness, and different models have different rules and work in different conditions. When there’s a mismatch between these models and conditions, it encourages certain versions of history, which lead to MEV.

Why is MEV Detrimental?

MEV is essentially a cost that validators put on users for no real reason, without the community agreeing to it, and without understanding what these costs mean for users.

There are ethical worries around MEV and front-running, which could make people see blockchain networks in a negative light and draw more attention from regulators.

Big MEV Problem Explained Simply

So, why is MEV a big deal for blockchain networks and why should you care? Well, as we said at the start, MEV could mess up blockchains’ ability to create systems that are fair, open, permissionless, and decentralized!

By now, it should be pretty clear that organizing transactions to make a profit can cause many problems and could stop blockchain networks from delivering on their promises. But there’s more — MEV can also threaten a blockchain’s ability to keep a permanent record of transactions. This is because as the rewards for creating new blocks decrease over time and more people use the network, there might be MEV opportunities that make more money for a validator than just creating a new block. In fact, some MEV opportunities could be so profitable, a validator might even try to change past transactions so they get the profits instead. That’s why MEV is a problem we really need to solve.

Don’t worry, there are already some clever people discussing this issue. Some of these solutions are already being used, while others still need to be looked into.

Possible MEV Solutions

Before we look at the possible solutions, it’s important to say that we don’t know yet if MEV can actually be completely solved. Some people, like the folks at Flashbots, think that it’s almost impossible to completely get rid of MEV. They believe the best solution is to make sure everyone has a fair shot at MEV to stop one group from controlling it all. Others, like Chainlink, think that MEV can be reduced a lot, to the point where it’s not worth it for people to take value from the blockchain system. We’re not going to argue about that here. We just want to help you understand what the different solutions might be.

There are four main types of possible MEV solutions: 1) Auctions, 2) Cryptography, 3) Fair Ordering, and 4) Regulation. Each of these have good and bad points, which we’ll talk about soon. We’ll probably need a mix of these solutions to really tackle the bad effects of MEV.

1. Auctions

Auctions are a simple way to handle the MEV issue. The basic idea is to let validators bid to get the chance to build a block.

This is the most common MEV solution being used right now, and here are the good and bad points of an auction-based MEV system.

Pros:

Efficient Price Discovery — Auctions can help find the right price because people compete to bid on things. In this case, those things could be 1) the chance to organize transactions and MEV opportunities, and 2) the chance to create blocks. This helps make sure things are priced correctly based on supply and demand, leading to better price stability and less volatility.

Transparency — Auctions are usually transparent, meaning everyone can see the prices others are offering. This helps build trust because everyone can see that the auction is fair and open.

Fairness — Auctions can be fair by giving everyone an equal chance to bid, no matter how big or small they are. This helps make sure everyone has a fair chance to get what they want.

Liquidity — Auctions can help make the market more liquid by providing a place for buyers and sellers to trade quickly and easily. This can help make the market more efficient by reducing transaction costs and helping find the right price.

Cons:

Market Manipulation — Auctions can be manipulated, especially if there aren’t many people participating or if some bidders have a lot of power. This can lead to distorted prices and make the market less efficient, which can hurt participants.

Limited Access — Not everyone might be able to participate in auctions, especially those who don’t have the resources needed (MEV is a very competitive and resource-heavy industry). This can limit the number of potential buyers and sellers, which can reduce market efficiency and liquidity.

High Transaction Costs — Auctions can be expensive, especially if there are auctioneers or other middlemen involved (it costs money to build the infrastructure and make sure it’s fair, transparent, and efficient). These costs can reduce profits and make people less likely to participate in auctions.

Limited Price Certainty — Auctions can be unpredictable, with the final price often being very different from early estimates. This can be a problem for both buyers and sellers who might not know the true value of what’s being auctioned, leading to uncertainty.

That being said, here are a few solutions that are being implemented, developed, and/or researched today that tackle MEV from an auction perspective.

Blink: Blink is developing a marketplace where searchers can bid on user transaction order flow and some of the profit will be sent back to the users.

BloXRoute BackRunMe: BackRunMe is a DEX solution for users created by BloXRoute that is integrated with Sushiswap and Uniswap. BackRunMe offers front-running protection by sending user transactions directly to validators while searchers share a portion of their back with the users.

DFlow: DFlow is Cosmos-based appchain that is building a decentralized orderflow marketplace to allow users to trade marketable order flow (unfulfilled buy and sell orders). Users can directly sell their orders to market makers, bypassing the typical MEV issues they run into on-chain.

Eden Network: Eden Network is another Flashbots like project that is building similar products. They have a private RPC endpoint for transactions, a place for searchers to submit bundles, and a place for builders to create blocks for validators.

Flashbots MEV-Boost: Flashbots is the leading MEV project and has developed their version of the Proposer/Builder Separation mechanic within Ethereum. Flashbots has created a marketplace for valuable blocks which is sourced from specialized builders and searchers. Over 90% of the validator market share is connected to MEV-Boost.

Flashbots Protect: Flashbots created an API that developers can integrate into their applications, which allows users to send their transactions through the Flashbots Network. There is also an RPC endpoint that users can connect their wallets with to send transactions to the FB Network.

Flashbots SUAVE: Flashbots initiative to further decentralize the MEV ecosystem. SUAVE stands for Single Unifying Auction for Value Expression and will attemp to unbundle the mempool and block builder role from existing blockchains.

Kolibrio: Kolibrio is another MEV solution that attempts to drive value back to the users. Kolibrio lets users, RPC nodes, and other transaction broadcasters submit transactions through a relay where the transactions are checked for MEV, which is shared back with the broadcaster.

Manifold Finance OpenMEV: OpenMEV aims to provide a credible neutral platform for facilitating both aggregation and direct communication channels between block validators, block producers and block synchronizers for the Ethereum and EVM-based networks.

Mekatek: Mekatek is building an open blockspace market for the interchain future, that enables expression of a rich set of preferences and to guarantee fee distribution to all parties in the value chain.

Proposer/Builder Separation: Ethereum currently allows block proposers/validators to choose transactions to include in blocks, which can lead to market manipulation and advantages for centralized pools. Proposer/builder separation (PBS) splits the block construction and proposal roles, with builders submitting bids for exec block bodies and proposers only accepting the highest bid.

Rook: Rook takes a slightly different approach to MEV by attempting to capture it at the application layer and then redistributing it back to the users who generated it. It does this through a coordination game whereby their Keepers (searchers) bid against other searchers in a zero-sum manner to disincentive MEV.

WallChain: Wallchain integrates with DeFi platforms and helps capture those profits, fully eliminating malicious bots. The captured profits significantly increases the DeFi revenue as well as helps provide users cashback.

2. Cryptography

Another way of dealing with MEV is through cryptography where the basic premise is the create some form of privacy around transactions via a commit and reveal scheme so that it’s more difficult for searchers, block builders, and validators to access MEV in the first place.

This also has its own advantages and disadvantages.

Pros:

Privacy — Cryptographic solutions can provide privacy, which can work well with auctions by letting participants privately submit bids and MEV transactions. This can encourage more honest bidding for MEV opportunities and help prevent “MEV stealing” and other exploitations. Privacy can also help mitigate MEV by hiding user transactions until a validator commits to adding them to their block, which would protect these transactions from MEV extraction altogether.

Fairness — Cryptographic solutions can also promote fairness in the MEV ecosystem. They can help verify the integrity of transactions and ensure they follow a pre-agreed set of rules. New cryptographic techniques, like homomorphic encryption, can also allow computations to be done on encrypted data without needing to decrypt it, which could prevent MEV altogether.

Cons:

Complexity and Cost — Cryptographic solutions can be complex and require a lot of technical expertise to implement and use effectively. This can be a barrier for smaller applications or protocols, reducing the number of MEV-resistant projects in the ecosystem and thus reducing competition too.

Vulnerabilities — Cryptographic solutions may introduce new vulnerabilities or attack vectors, especially if the cryptography is not well-designed or implemented correctly. This can increase the risk of security breaches or other types of exploits.

Some projects that are looking to tackle MEV through cryptography are:

Anoma: An intent-centric, privacy-preserving protocol for decentralized counterparty discovery, solving, and multi-chain atomic settlement. Anoma has been working on Ferveo, which is a protocol for mempool privacy using distributed key generation and threshold cryptography.

Fairblock: Fairblock is building a solution to combat bad MEV by using distributed Identity Based Encryption (IBE). IBE is a novel, secure, and efficient pairing-based scheme that can be used to enable pre-execution privacy. Users will be able to use FairBlock to send encrypted transactions and once an order is finalized, the transactions are decrypted and then executed.

Oasis Network: Oasis Network is a decentralized layer 1 blockchain solution designed to support confidential and private transactions and smart contracts, which can help mitigate MEV.

Secret Network: Secret Network is a privacy-preserving blockchain that enables “secret” smart contracts with encrypted inputs, outputs, and state. This means that they have an encrypted mempool, which helps to mitigate MEV.

Shutter Network: Shutter Network is an open-source project that aims to prevent front running on Ethereum by using a threshold cryptography-based distributed key generation (DKG) protocol.

3. Fair Ordering

Fair ordering solutions are a third way of trying to prevent MEV and are fairly straight-forward to understand. The idea is that the protocol itself will be able to order transactions in a fair way so that transactions aren’t able to be front-run or back-run.

Fair ordering also comes with it’s own set of pros and cons.

Pros:

MEV Mitigation — By ensuring a fair order to transactions, where no transaction can be purposely inserted before or after another, this can completely prevent searchers from consistently front-running or back-running users. This method has the potential to fully eliminate MEV.

Cons:

Complexity — Designing a fair distributed system can be complex and challenging, as there are many factors to consider and trade-offs to make. This can lead to delays and increased costs.

Subjectivity — Fairness can be subjective, and different stakeholders may have different opinions on what is fair. This can lead to disputes and challenges in implementing a fair system that is acceptable to all.

Scalability — A fair system might be more difficult to scale, as maintaining fairness across a large and growing number of participants can be challenging. This can lead to performance issues and increased costs as the system grows.

Fair ordering techniques to solve MEV are the most emergent solution of solving MEV. Here are a few projects that are being researched.

Aequitas: Aequitas are first consensus protocols that provide order fairness. It provides a leader-based and a leaderless protocol each for the synchronous and asynchronous settings, for a total of four protocols that all provide consistency, block-order-fairness, and some form of liveness.

Fairy: Fairy is a system that makes sure transactions in a distributed network are ordered fairly, so no one can cheat by changing the order based on who sent the request. It does this by using special computer environments called Trusted Execution Environments (TEEs) to protect the transactions and make sure they’re ordered correctly. Fairy is better than other similar systems because it also hides who sent the request, not just what the request is.

Helix: Helix is a way to make sure that transactions on a distributed network are fairly ordered. It does this by using encryption to hide information from the nodes that are ordering the transactions, which makes it harder for them to cheat. Helix also uses a verifiable source of randomness to choose which nodes get to order transactions, and it gives more power to nodes that have a good reputation for following the rules. This helps make sure that the system works fairly and efficiently.

4. Regulation

A less discussed method of mitigating MEV is simply good old fashioned regulation. Ban the act of front-running or back-running transactions or create higher tax implications for actors that participate in MEV.

That being said, this also creates costs and benefits that we’re all very familiar with.

Pros:

Consistency — Regulation provides a uniform set of rules that everyone must follow, reducing confusion and creating a fair environment.

Accountability — Regulation sets clear responsibilities and expectations for those participating in MEV, making it easier to hold them accountable for their actions.

MEV Prevention or Mitigation — Regulation can protect the public from MEV by setting standards or restrictions for transaction behavior, ordering transactions, bidding, front-running, etc.

Cons:

Costs — Regulation can be expensive to put in place, both for the regulators and those being regulated. Compliance can require significant resources, and the cost of enforcement can be high.

Inefficiency — Regulations can be rigid and slow to adapt to changes in the environment. They can also create unintended consequences or incentives that work against their intended goals.

Compliance Issues — Some regulated parties may try to avoid the regulations, either through legal loopholes or outright violations, leading to enforcement challenges and potential negative consequences.

Stifling Innovation — Overly strict regulations can suppress innovation, particularly in emerging areas where flexibility is important.

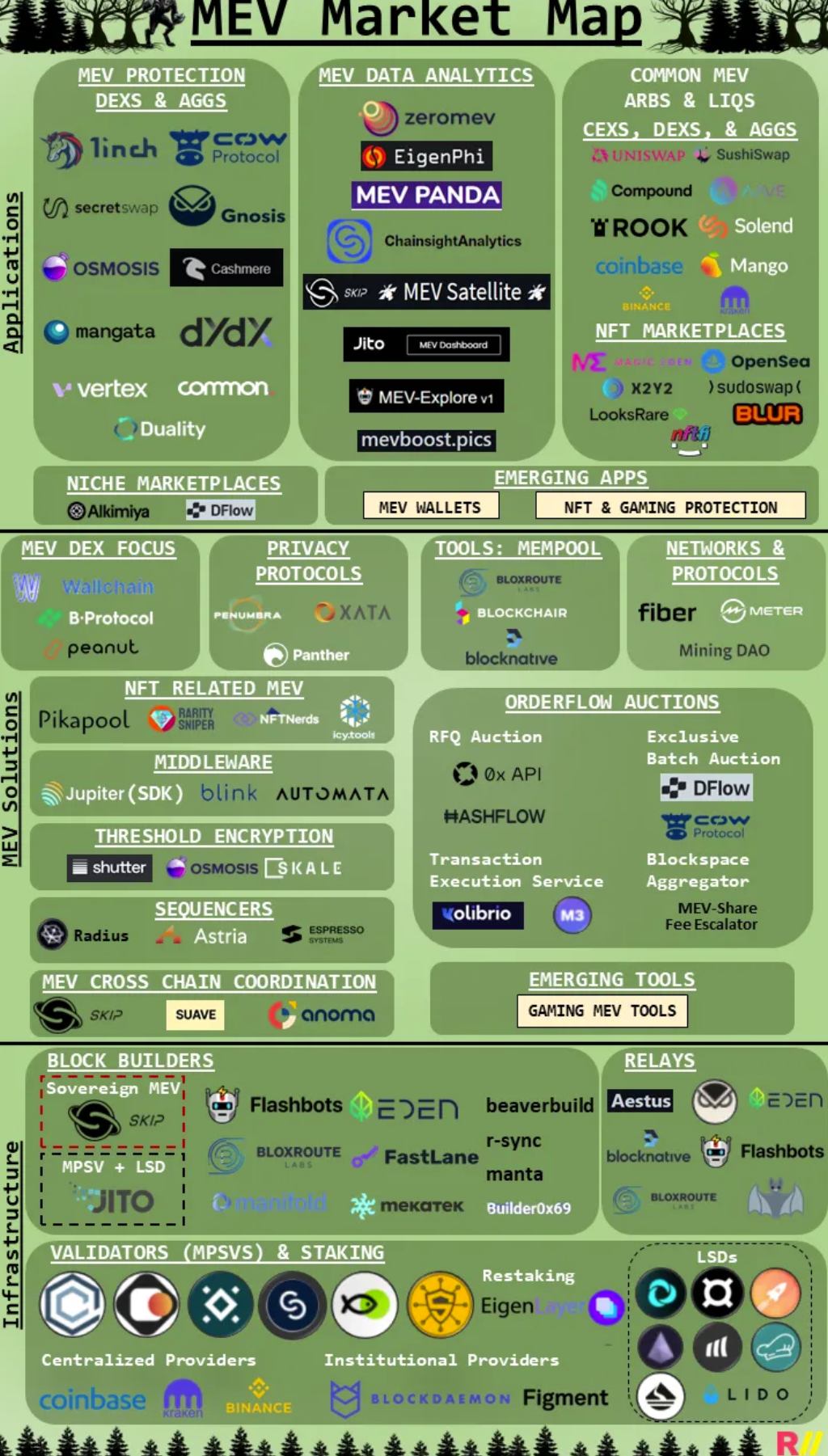

The companies that we listed above are only a select few out of the many that are trying to mitigate or solve MEV. Here’s a more holistic market map of the entire industry (kudos to AnalyticalAli for creating this amazing market map!)

MEV Market Map — All Credit Goes to AnalyticalAli

Conclusion

So, we’ve finally reached the end of our deep dive into MEV. It’s crazy, right? This isn’t just about the nuts and bolts of blockchain, it’s so much more. We’re talking big picture stuff, like who’s in charge, how we handle power, and what decentralization really means. MEV shows us the tricky balance between the chance for everyone to get involved and the risk of some folks taking advantage. It makes us stop and think about the give-and-take between fast and fair, being open versus keeping stuff private, and choosing between what’s good for one person and what’s good for all of us.

At the end of the day, what happens next with MEV is up to us, the blockchain community. Our choices will shape what decentralization looks like in the future. Do we let the allure of MEV sway us, risking the principles of decentralization? Or do we face the challenge head-on, come up with creative solutions that put users first, and work towards a crypto ecosystem that’s fair and inclusive? We don’t know how it’ll pan out just yet. But let us tell you, the stakes are high, and whatever happens, it’s gonna ripple out and have a huge impact.